How Many Jobs Are Available in Real Estate Investment Trusts?

How many jobs are available in real estate investment trusts? Real Estate Investment Trusts are referred to as REITs in the United States. The real estate sector is seeing robust growth, which is excellent news for real estate investment trusts as they continue to expand their operations.

Hearing that there are plenty of positions available is great news for anyone who is interested in pursuing a career with a REIT but hasn’t done so yet.

How many different career opportunities are there to be found in real estate investment trusts? What kinds of job opportunities can one expect to find working in the REIT industry?

This book will cover a variety of topics, including the number of employees now available, the operation of real estate investment trusts, and much more.

What Are Real Estate Investment Trusts?

More than 225 real estate investment trusts (REITs) are now operating in the United States, and their total market capitalization exceeds one trillion dollars.

A public investment entity that is listed on a stock exchange is known as a real estate investment trust (or REIT for short).

In addition, investors may diversify their holdings across a wide variety of real estate asset classes by purchasing REIT exchange-traded funds (ETFs).

A real estate investment trust (REIT) is a company that invests in and manages income-producing real estate and other assets.

In addition, the REIT could own buildings such as hotels, resorts, offices, and other types of establishments.

However, the real estate that the REIT purchases is not intended for resale in the future. Instead, the development will take place on the land that the REIT controls.

After that, the piece of real estate is included in the investment portfolio so that it may begin producing money.

The purchasing and selling of these assets are made simple and cheap for investors. Additionally, compared to typical real estate investments, REITs offer much-improved liquidity.

The New York Stock Exchange, the American Stock Exchange, and the NASDAQ all provide listings for real estate investment trusts (REITs).

In addition, investors can have access to REITs indirectly through mutual funds by purchasing shares in such funds.

Investing in real estate investment trusts (REITs) enables groups of investors to make large-scale real estate investments that would not be feasible under any other circumstances.

By purchasing shares in a REIT, individual investors with smaller capital can access bigger real estate markets.

The real estate investment trust (REIT) market is forecast by experts to see further expansion and diversification, which will likely result in the creation of a significant number of new employment opportunities.

How Do Real Estate Investment Trusts Work?

The United States Congress established real estate investment trusts in the year 1960. This initiative aimed to broaden access to opportunities for financial gain associated with investing in income-generating real estate.

Investing in a real estate investment trust (REIT) is, without a doubt, the same as investing in any other sector. Check the condition in Canada here.

Investors purchase shares, and the bulk of the revenue generated by real estate investment trusts is distributed to the shareholders of such trusts.

REITs are required to abide by a set of regulations established when Congress initially constituted REITs as legal entities.

All REITs must be structured similarly to mutual funds, be viewed as corporations by the Internal Revenue Code, and have a broad base of shareholders.

In addition to this, REITs must hold real estate with a long-term investment horizon and must predominantly own or finance real estate.

According to the Internal Revenue Code, a minimum of 75% of a corporation’s revenue must originate from the sale of real estate assets, real estate interest, or rental income from real estate.

The corporation must have at least 75% of its assets invested in real estate, and 95% of the firm’s revenue must be passive for the corporation to qualify.

Are REITs a Good Investment?

Consider putting some of your money into a real estate investment trust (REIT) if you want to broaden the scope of your investment portfolio without taking on undue risk.

There is still some risk involved because no investment is completely risk-free, but there are some excellent benefits to investing in a real estate investment trust in order to increase one’s wealth.

Because of the way it operates, a REIT is exempt from paying corporation tax. Stocks that pay dividends are frequently subject to taxes at both the corporate and individual levels.

The good news is that real estate investment trusts are not subject to taxation at the corporate level. This implies that REITs benefit from a significant tax advantage.

REITs are required to distribute ninety percent of their taxable income to their owners. The dividend yield on the typical stock is less than two percent, while real estate investment trusts (REITs) sometimes have more than five percent yields. Because of this, purchasing shares in a REIT is a good choice for anybody wishing to generate income or earn additional money to put back into the market.

The value of real estate typically increases over time.

Consequently, many REITs are now in a position to capitalize by selling desirable assets and investing the proceeds in other areas.

Because of these tactics, a number of REITs offer returns that significantly surpass those of the market.

REITs are Ideal for Smaller Investors

Small real estate investors now have the opportunity to own a piece of a commercial real estate portfolio that was previously out of their reach.

The majority of people do not have the financial resources necessary to acquire an office tower or shopping complex.

Everyone can now experience the benefits of investing in these kinds of buildings and obtaining a return on their investments thanks to the formation of REITs by Congress.

A solid strategy for one’s financial future requires the maintenance of a diversified investment portfolio.

Investing in a REIT is quite similar to investing in the stock market, with the exception that it involves real estate rather than securities.

Having real estate as part of an investment portfolio is highly recommended by financial experts due to the fact that real estate typically maintains its value even in the midst of an economic crisis.

You almost always get a reliable income when investing in a real estate investment trust (REIT).

When someone owns real estate, selling that property can be time-consuming.

On the other hand, purchasing or selling an investment in a REIT may be done with the simple click of a mouse.

Because of the high degree of liquidity it offers, REIT is an appealing investment opportunity.

Real Estate Industry Job Statistics

The Department of Labor of the United States of America reports that there will be an increased need for property managers, real estate brokers, and sales agents in the near future.

There are hundreds of thousands of individuals working in this area across the United States, and the average annual salary for workers in this sector is $51, 220.

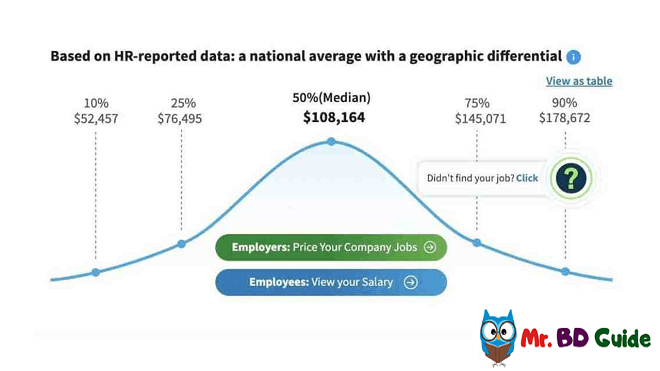

The typical pay of those working in the REIT industry is significantly higher than those of real estate agents.

As of May 2022, the typical annual salary of a Real Estate Investment Trust (REIT) analyst was $108,164, which was more than double the amount earned by real estate brokers and sales agents.

On the other hand, the compensation range typically falls between $76 495 and $145 071 each year.

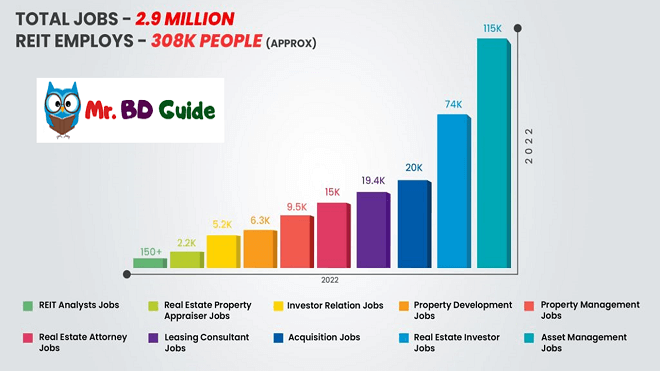

Organizations that are classified as REITs are responsible for the full-time employment of 274,000 workers.

It is projected that real estate investment trusts are indirectly responsible for creating 2.6 million full-time employees.

The expansion of REIT companies is fantastic news for anybody interested in pursuing a career working for one of these businesses.

This results in a large number of options for employment as well as the capacity to earn a much better income than in other areas of the real estate sector.

Types Of Jobs Available In Real Estate Investment Trusts

The real estate investment trust (REIT) business offers a diverse selection of career opportunities for interested parties.

To help you better grasp this topic, I’ve included job descriptions for the primary positions that are now open.

Development Roles

The construction of brand-new projects is under the purview of development. Any individual who is seeking for a job in project management would do well to consider taking on this post.

This function requires the creation of new initiatives and collaboration with others to secure funding for the projects.

Working in the development field within the REIT business is desirable because it pays well, is demanding, and is well recognized.

Acquisition Roles

Real estate investment trusts sometimes have positions available called “acquisition jobs,” which require candidates to find new investment possibilities.

In addition, these jobs ensure that agreements are completed successfully. In addition, these positions are available in REITs and pay handsomely.

The work is highly tied to money, and those with a degree of expertise in finance, marketing, business, or capital markets are ideal candidates for the position.

Property Management Roles

Property managers are accountable for monitoring the entirety of a building’s operations, including but not limited to leasing, maintenance, collections, and anything else that may be necessary.

To become a property manager, you do not need to fulfill any bare minimum criteria. Candidates who are adept at managing projects and can cope with a range of challenging circumstances are ideal.

Beginning one’s career in a real estate investment trust (REIT) as a property manager is frequently a fantastic opportunity.

This is because there is a strong opportunity for professional growth whenever there is an opening for a different function within the business and new positions become available.

Asset Management Roles

In the field of asset management, one’s primary responsibilities include monitoring both the operational and financial well-being of a real estate investment trust’s portfolio.

An asset manager must manage the client’s assets in accordance with the investment goals and preferences that have been agreed upon.

Asset managers are responsible for creating, organizing, and upkeep their clients’ portfolios.

A skilled asset manager will have the ability to collaborate effectively with a wide array of different organizations.

Asset managers are involved in various activities, including acquisitions, accounting, development, and finance.

These activities all interact with one another to help achieve objectives.

At the same time, they are responsible for ensuring that they are in compliance with the SEC, the requirements for REITs, and Sarbanes-Oxley.

It is not unheard of for someone to begin their career working in acquisitions or property management and eventually work their way up to being an asset manager of residential or commercial properties.

Alternately, someone who possesses the necessary abilities should have little trouble obtaining a position in asset management right away.

Investor Relationship Roles

The Investor Relations department is in charge of organizing and managing all interactions with REIT shareholders.

This position offers competitive compensation and is ideally suited for those with prior experience in accounting or finance.

The investor relations team will organize the annual meeting and the meeting papers, which will comprise the proxy statement and annual report.

And all of this needs to be done in a compliant way with the SEC’s requirements.

If you have experience in finance or accounting, you would be a strong fit for this position, and we encourage you to apply.

How Many New Real Estate Investment Trust Jobs Are There?

Now, if you’re curious about how many opportunities are available, data from LinkedIn reveals that there are now more than one thousand jobs available inside real estate investment trusts.

That’s only one location, but it’s a good indication that plenty of other opportunities are available in the sector.

A market segment that is showing rapid expansion is the REIT business. In addition to the requirement of investors, a large number of additional support functions need to be consistently staffed.

Why Real Estate Investment Funds a Good Career Choice?

Typically, these investment trusts provide a reliable stream of consistent income. Investors receive a return of 90% of the earnings. Diversification: When stocks are declining, real estate investment trusts perform better since they have no link to the performance of other asset classes.

Is Working with a REIT Right for You? Working with a REIT is a career path that blends real estate knowledge with corporate financial skills. Real estate investment trusts are classified into several types, including:

- Data Centers

- Diversified or Combination

- Medical Care

- Industrial

- Infrastructure

- Hotel or resort

- Mortgage

- Office

- Residential

- Retail

- Self-Storage

- Specialty

- Timberlands

REITs offer numerous advantages to consumers. These are some examples:

- Dividend payouts

- Simple liquidity

- Partial independence from the performance of the S&P 500

- Allows investors to profit from real estate market gains without purchasing a property.

- Tax advantages because most countries have a REIT statute that allows a real estate firm to pay minimal capital gains and corporation tax.

Final Words

The real estate investment trust business has already reached a significant scale and is expected to keep expanding.

Working for a real estate investment trust (REIT) requires adhering to stringent rules for reporting and laws.

The applicant for many positions inside real estate investment trusts has to have previous experience in accounting or finance in order to be considered.

Nevertheless, alternative roles may be played that do not have these limitations.

After beginning employment in a REIT company, one has the opportunity to advance into other responsibilities if and when those opportunities become vacant.

FAQ: How Many Jobs Are Available in Real Estate Investment Trusts?

Although a career in the financial services industry is not the right choice for everyone, it does come with perks and benefits.

It is feasible to make a decent base wage in a company that is rooted in a business that is not going anywhere – real estate — in particular when working for a real estate investment trust (REIT).

Required skillsets are similar to those found in professions closely connected to this one, such as data science.

You will probably find them highly transferable if you ever need to or want to make a shift in your line of work.

How Many Real Estate Investment Trusts are There?

There are more than 225 REITs in the U.S. registered with the SEC that trade on one of the major stock exchanges—the majority on the NYSE.

How Many Members Does a REIT Have?

A REIT has 100 shareholders/members. Beginning with its second taxable year, a REIT must meet two ownership tests: it must have at least 100 shareholders (the 100 Shareholder Test). And five or fewer individuals cannot own more than 50% of the value of the REIT’s stock during the last half of its taxable year (the 5/50 Test).

Can a REIT Have Employees?

Conflicts of Interest: Non-traded REITs are typically externally managed—meaning the REITs do not have their own employees.

Is Real Estate Investing a Full-Time Job?

As a full-time real estate investor, you’re going to deal with a lot more stress than any 9-5 job will ever bring you, so if you want to take the plunge and quit your job, you’ll be far better served to pace yourself and make sure you’re betting on a sure thing before you take that leap of faith.

How Big is the REIT Industry?

REITs own approximately $3.5 trillion in gross real estate assets, with more than $2.5 trillion from publicly listed and non-listed REITs and the remainder from privately held REITs.

How Many Houses are Owned by REITs?

Multiplying the share of fund ownership by the share of funds with REITs by the number of households with equities and summing across fund types yields the total number of households with REITs. As shown in row (4) of Table 2, over 56 million households (approximately 44% of households) have REITs.

What Happens If a REIT Fails the Income Test?

Suppose we fail to satisfy one or more requirements for REIT qualification, other than the gross income tests and the asset tests, and the violation is due to reasonable cause. In that case, we may retain our qualification as a REIT but will be required to pay a penalty of $50,000 for each such failure.

How Long Do You Have to Hold a REIT?

REITs should generally be considered long-term investments. In many cases, this can take around 10 years to occur. And with publicly-traded REITs that fluctuate with the stock market, Jhangiani recommends holding onto them for at least three years.

How Do You Get a Job in Real Estate Investing?

How to Start Your Career in Real Estate Investing: 5 Steps. Step 01: Get some education. Step 02: Choose a real estate investing strategy. Step 03: Select a target real estate market. Step 04: Get investment property financing. Step 05: Have a real estate marketing strategy.

Is the REIT Industry Growing?

As of Dec. 1, 2021, REITs are up nearly 29% for the year, with strong performance across sectors. REIT stock total returns since the onset of the pandemic are now in excess of 20%. The robust recovery speaks to the unique nature of the COVID-19 crisis for real estate and the resilience of REITs.

Check our Sources:

- U.S. Bureau of Labor Statistics. “The Employment Situation-September 2021.”

- Nareit. “REIT Sectors.”

- Fidelity. 2021. “Real Estate Investing 2021 Outlook.”

- Nareit. 2021. “REITs Supported 2.6 Million Jobs in 2019.”

- Indeed. “Real Estate Investment Trust Jobs, Employment.”

- ZipRecruiter. “Q: How to Become a Real Estate Analyst.”